This sections let you manage tax rules to be applied on customer's invoices.

Things to consider before Tax Rule Creation

- Tax rules are defined by { Country,State Province and Tax Code }, { Country, Zip } or { Country, State Province and Zip } combinations

- E.g., Consider tax rule definition for a country like USA, leaving state, province and zip code as blank means that the tax rate is applied to all the customers from US. If you want to define a rule for a particular state, provide the Country and State values while defining the rule

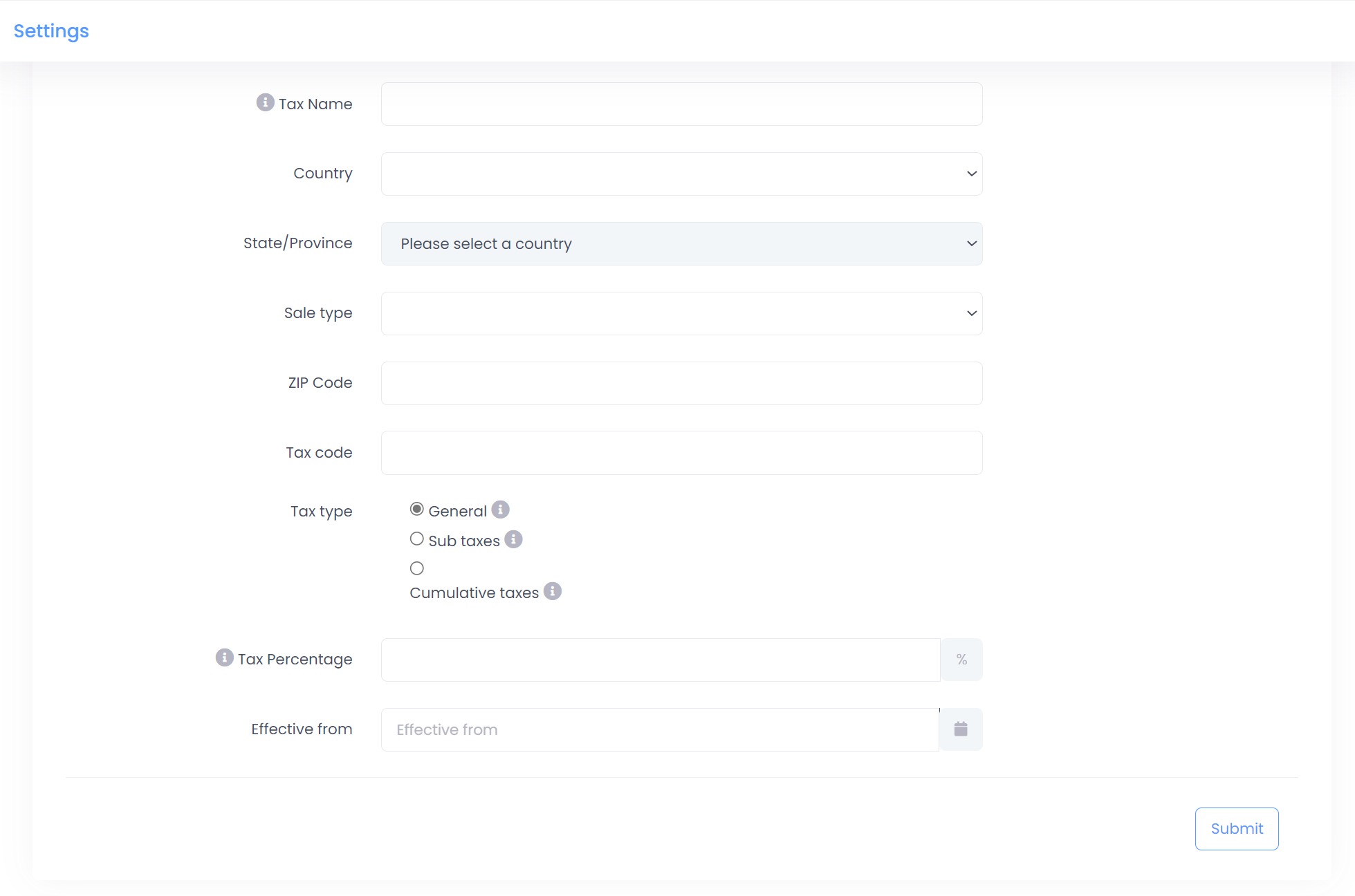

Create Tax Rule

- Click on Add Tax Percentage button

- Define the rules by following the on-screen instructions

- Tax Name : Specify the Tax Name here to be visible on customer's invoice e.g., GST, VAT

- Country : Specify country from dropdown that tax rule will be applicable to

- State/Province : Customers from specified State from dropdown that tax rule will be applicable to

- Sale Type : Specify the tax rule applicability on sale type(option below), leaving is blank will consider both Products & Services

- Product

- Service

- Zip Code : Customers from spcified Zip Code will be entitled to this tax rule

- Tax Code :

- Tax Type : Several tax type options are available in C3, Choose one as per your requirement

- General : Single tax percentage applied on the total amount.

- Sub Taxes : The tax percentage for this definition will be the total ( sum ) from the child tax rules.

- Cumulative : The tax percentage for this definition will be the total ( sum ) from the child tax rules.

- Tax Percentage : Specify the tax percentage here

- Effective From : Specify the date using Date picker post which all generated invoices will be entitled to tax rule being created

- Click on Submit button

Things to note post Tax Rule Creation

- Tax rules are considered while generating invoices for customers

- You can update or delete the existing tax rules as per requirement

- In order to manage existing taxes you can use the Edit/Delete Icons available next to the tax rules